Nokia plans to cut one in five jobs at its global cellphone business as it loses market share to rivals Apple and Samsung and burns through cash, raising new fears over its future.

Nokia plans to cut one in five jobs at its global cellphone business as it loses market share to rivals Apple and Samsung and burns through cash, raising new fears over its future.

In a second profit warning in nine weeks, Nokia said on Thursday that its phone business would post a deeper-than-expected loss in the second quarter due to tougher competition.

Nokia Slashes 10,000 Jobs

Ex-loan officer claims Wells Fargo targeted black communities for shoddy loans

For nearly a decade, Beth Jacobson lived inside the vast machinery of subprime mortgages that shook the nation’s economy.

For nearly a decade, Beth Jacobson lived inside the vast machinery of subprime mortgages that shook the nation’s economy.

In sworn court testimony, she describes watching loan officers comb through heavily black areas such as Baltimore and Prince George’s County, forging relationships with churches and community groups to sell them shoddy loans. She says she processed homeowners with sterling credit ratings for higher interest rates than they needed to pay. And she says she pumped out millions of dollars in mortgages to people with no paperwork and low incomes to become Wells Fargo’s top-producing loan officer.

Crime 'one of the world's top 20 economies', says UN official

Crime generates an estimated $2.1 trillion in global annual proceeds - or 3.6pc of the world's gross domestic product - and the problem may be growing, a senior United Nations official has said.

Crime generates an estimated $2.1 trillion in global annual proceeds - or 3.6pc of the world's gross domestic product - and the problem may be growing, a senior United Nations official has said.

"It makes the criminal business one of the largest economies in the world, one of the top 20 economies," said Yury Fedotov, head of the UN Office on Drugs and Crime (UNODC), describing it as a threat to security and economic development.

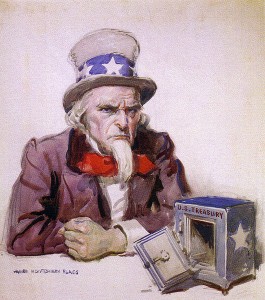

One Nation Under Debt With Endless Debt Slavery For All

Our entire economy is now based on debt. We are told that we have to go into debt for everything.

Our entire economy is now based on debt. We are told that we have to go into debt for everything.

Debt is a "soft" form of slavery. In America today, it is not legal to bind people up with chains and force them to work for you, but that doesn't mean that there are not millions upon millions of slaves in this country. When you borrow money, you willingly become a servant to the lender. Sadly, there are millions of Americans that will spend the rest of their lives working to pay off their debts but they will never escape the endless debt slavery that they have gotten themselves into. When you add up all forms of debt in the United States at this point, it comes to more than 54 trillion dollars. That is more than $178,000 for every man, woman and child in America. We truly are one nation under debt, and we have created the biggest debt bubble in the history of the planet. Unfortunately, all debt bubbles eventually burst, and when this one bursts the consequences are going to be unlike anything ever seen before.

The American who quit money to live in a cave

Daniel Suelo lives in caves in the canyonlands of Utah. He survives by harvesting wild foods and eating roadkill.

Daniel Suelo lives in caves in the canyonlands of Utah. He survives by harvesting wild foods and eating roadkill.

He has no job, no bank account and does not accept government welfare. In fact, Suelo has no money at all.

10 Big Companies That Pay No Taxes (and Their Favorite Politicians)

Between 2008 and 2011, 26 major American corporations paid no net federal income taxes despite bringing in billions in profits, according to a new report (PDF) from the nonprofit research group Citizens for Tax Justice. CTJ calculates that if the companies had paid the full 35 percent corporate tax rate, they would have put more than $78 billion into government coffers.

Between 2008 and 2011, 26 major American corporations paid no net federal income taxes despite bringing in billions in profits, according to a new report (PDF) from the nonprofit research group Citizens for Tax Justice. CTJ calculates that if the companies had paid the full 35 percent corporate tax rate, they would have put more than $78 billion into government coffers.

Here's a look at the 10 most profitable tax evaders and the politicians their CEOs, employees, and PACs give the most money to.

More Articles...

Page 18 of 70

Economic Glance

Economic Glance