While the Irvine subprime lender was failing, key executives continually changed their stock trading plans and often sold within days of colleagues' trades, a Times investigation shows.

No charges have been filed, and attorneys for the company's former top executives say that none of the executives sold stock based on information that had not been disclosed to the public and that the executives retained most of their shares when the company went under.

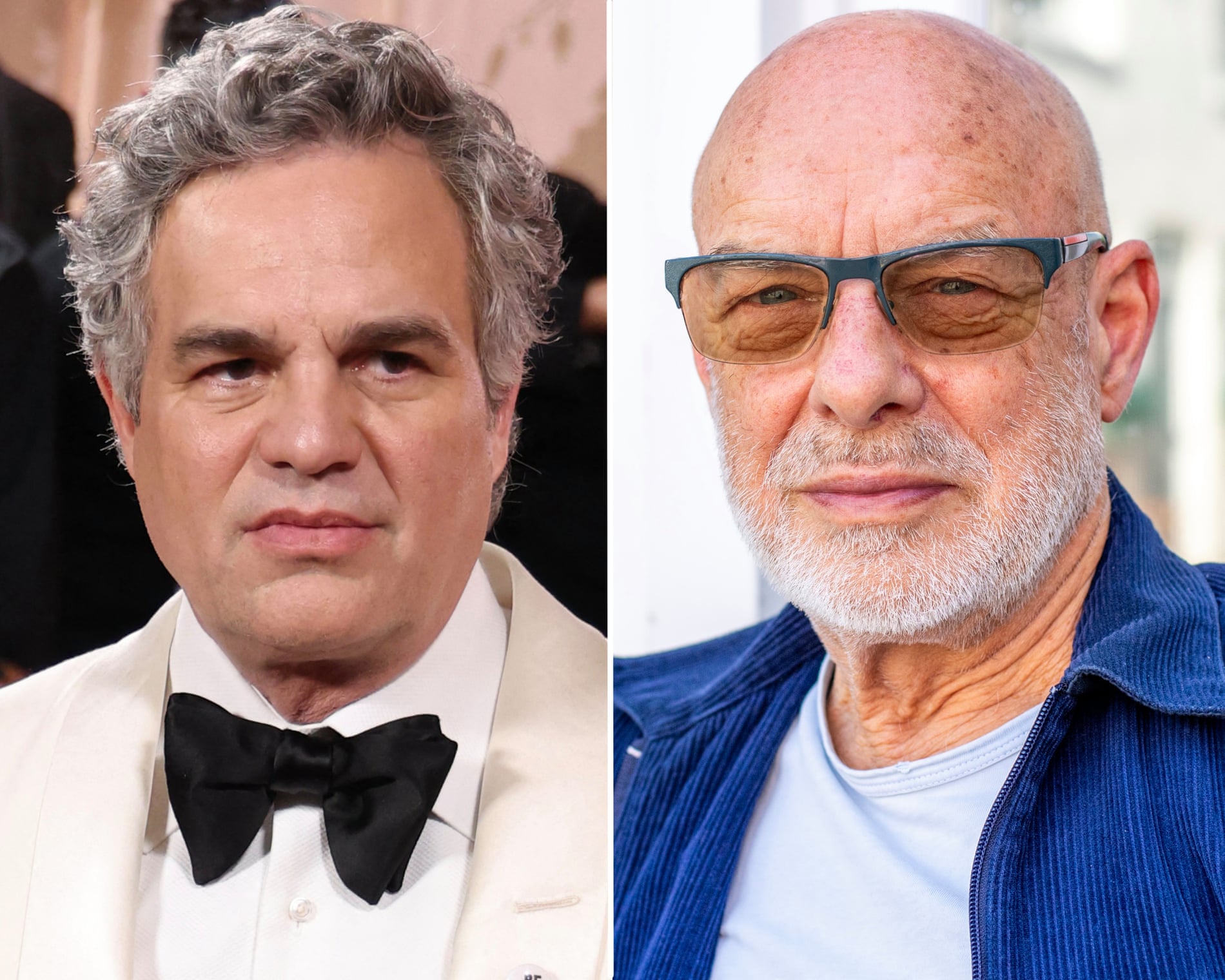

Nearly 400 millionaires and billionaires from 24 countries are calling on global leaders to increase taxes...

Nearly 400 millionaires and billionaires from 24 countries are calling on global leaders to increase taxes... United Parcel Service on Tuesday said it would cut up to 30,000 operational roles in 2026,...

United Parcel Service on Tuesday said it would cut up to 30,000 operational roles in 2026,...