The giant mortgage bubble and the irresponsible and corrupt practices that caused the catastrophic economic crash didn't emerge out of thin air. They were a consequence of decades of pay-to-play politics rife with conflicts of interest; a political system awash in cash and legal pay-offs, designed to undermine the checks and balances that could have prevented the meltdown.

Many of these checks and balances were implemented during the Great Depression. How they were eroded and eventually abandoned is the story of a small group of banks, financial companies and elites involved in major conflicts of interest, revolving-door politics and backroom deal-making -- all to protect the interests of the global elite at the expense of the American public.

Big Finance has a long history of working hard to deregulate the American economic system on behalf of global capitalism run amok. One of its biggest coups was the overturning of the Glass-Steagall Act, a Depression-era law that created a firewall between investment banking and the commercial banks that hold deposits and make loans.

The first victory in the quest to overturn this major protection came in 1986. Under intense pressure from Wall Street, the Federal Reserve reinterpreted a key section of Glass-Steagall, deciding that commercial banks could make up to 5 percent of their gross revenues from investment banking. After the board heard arguments from Citicorp, J.P. Morgan and Bankers Trust, it loosened the restrictions further: in 1989, the limit was raised to 10 percent of revenues, and in 1996, they hiked it up to 25 percent.

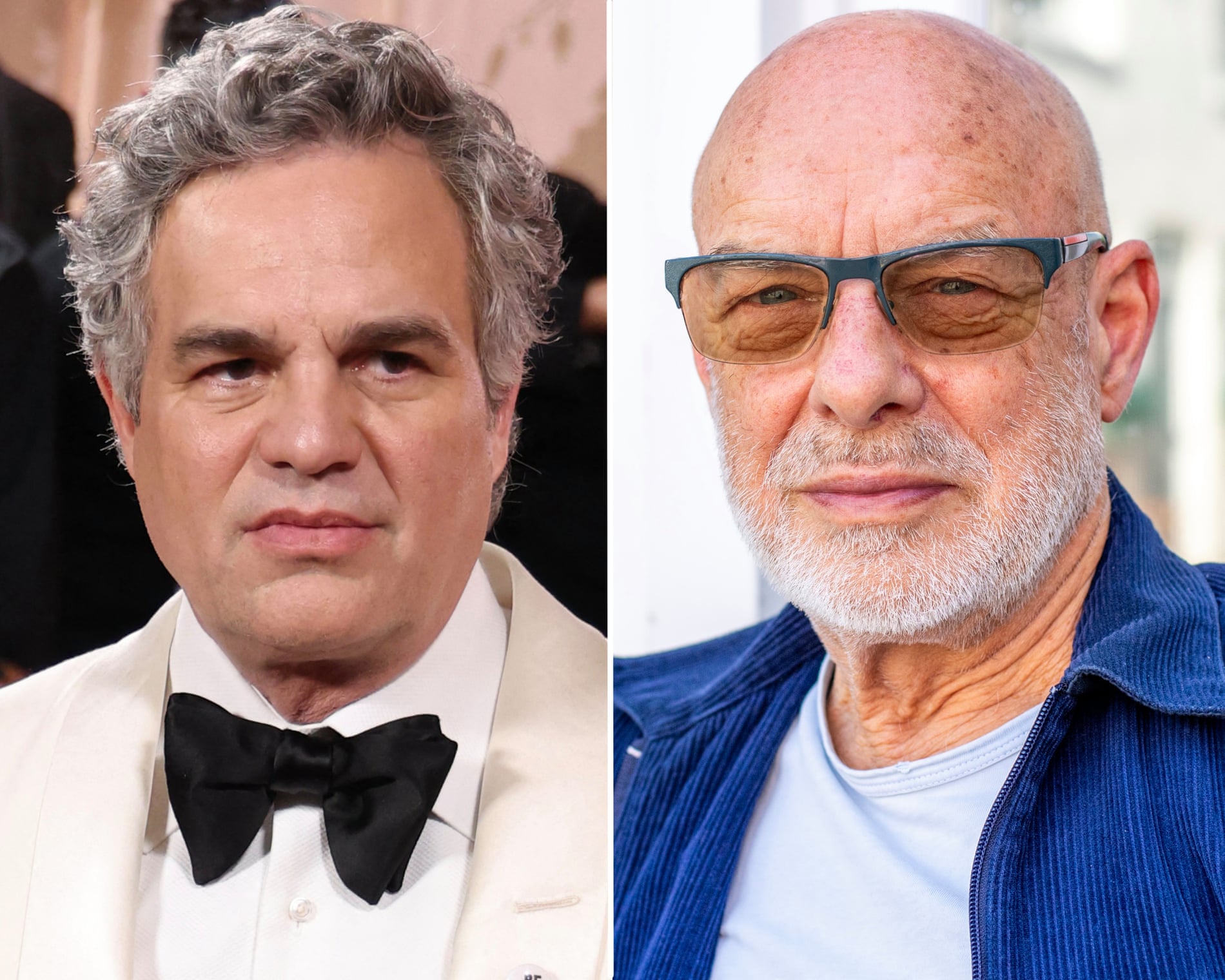

Nearly 400 millionaires and billionaires from 24 countries are calling on global leaders to increase taxes...

Nearly 400 millionaires and billionaires from 24 countries are calling on global leaders to increase taxes... United Parcel Service on Tuesday said it would cut up to 30,000 operational roles in 2026,...

United Parcel Service on Tuesday said it would cut up to 30,000 operational roles in 2026,...