It will cut payroll checks, receive federal and other funds earmarked for the state, and disburse educational or transportation or any other funds to their appropriate monetary endpoints. For its trouble, the bank will receive $1.3 million in state fees and the ability to re-lend idle state funds out to customers for private gain. Yes, you should be worried.

A global corporation with more than $2 trillion in assets and operations in 60 countries, JP Morgan Chase has been a major figure in the ongoing global financial crisis. As one of the largest private banks in the U.S., the bank made incredible amounts of money by underwriting many of the questionable loans (sub-prime, zero down, adjustable rate) that fueled the American housing bubble.

It then made even more money by packaging hundreds of these shitty loans into a single “product,” a mortgage backed security, which it sold like Twinkies to pious religious non-profits, filthy-rich hedge fund managers, municipal fire-fighters, retired auto-workers, and the like, each security effectively putting these groups on the hook—and not JP—for the shitty loans that it had helped create.

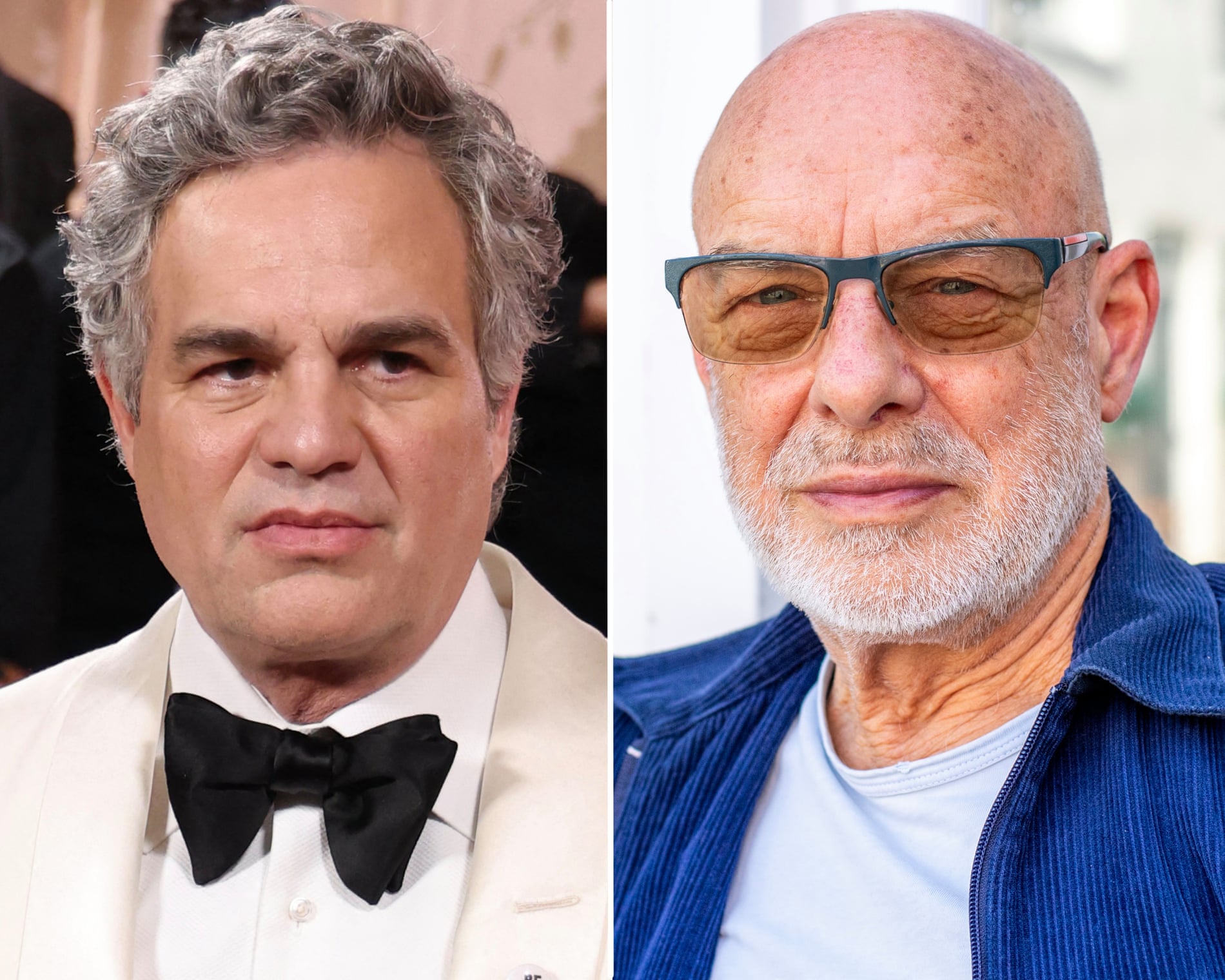

Nearly 400 millionaires and billionaires from 24 countries are calling on global leaders to increase taxes...

Nearly 400 millionaires and billionaires from 24 countries are calling on global leaders to increase taxes... United Parcel Service on Tuesday said it would cut up to 30,000 operational roles in 2026,...

United Parcel Service on Tuesday said it would cut up to 30,000 operational roles in 2026,...