Wall Street's plunge into the U.S. housing market reached such a level of madness that three giant banks kept buying billions of dollars in risky mortgage securities when most investors were shunning them, a congressional commission said Thursday in its long-awaited report on the causes of the U.S. financial crisis.

Wall Street's plunge into the U.S. housing market reached such a level of madness that three giant banks kept buying billions of dollars in risky mortgage securities when most investors were shunning them, a congressional commission said Thursday in its long-awaited report on the causes of the U.S. financial crisis.

An offshore market for the securities became "self fueling," the politically divided Financial Crisis Inquiry Commission wrote in its 533-page report, including lengthy dissents from Republican commissioners.

The panel charged that two of these banks, Citigroup and Merrill Lynch, which is now part of Bank of America, failed to disclose in a timely fashion tens of billions of dollars in mortgage risks to their investors.

The first full-scale analysis of the factors that led to the worst economic crash in 80 years, the report chronicles subprime mortgage lenders' issuance of "liars' loans" to millions of unqualified borrowers, how Wall Street repackaged them into exotic securities and how ratings agencies stamped them with phony Triple A ratings.

Federal regulatory agencies failed to police the runaway market, topped by the Federal Reserve Board's "pivotal failure" to regulate subprime mortgage lenders' issuance of a flood of mortgages to marginal homebuyers, the panel found. It said that key policymakers lacked a full understanding of the financial system they oversaw and that, at the height of the crisis, federal officials pressed the huge, government-sponsored mortgage lenders Fannie Mae and Freddie Mac to take on more risk, heightening taxpayer losses when they collapsed.

"There were warning signs. The greatest tragedy would be to accept the refrain that no one could have seen this coming and thus nothing could have been done," said Phil Angelides, the commission's chair. "If we accept this notion, it will happen again."

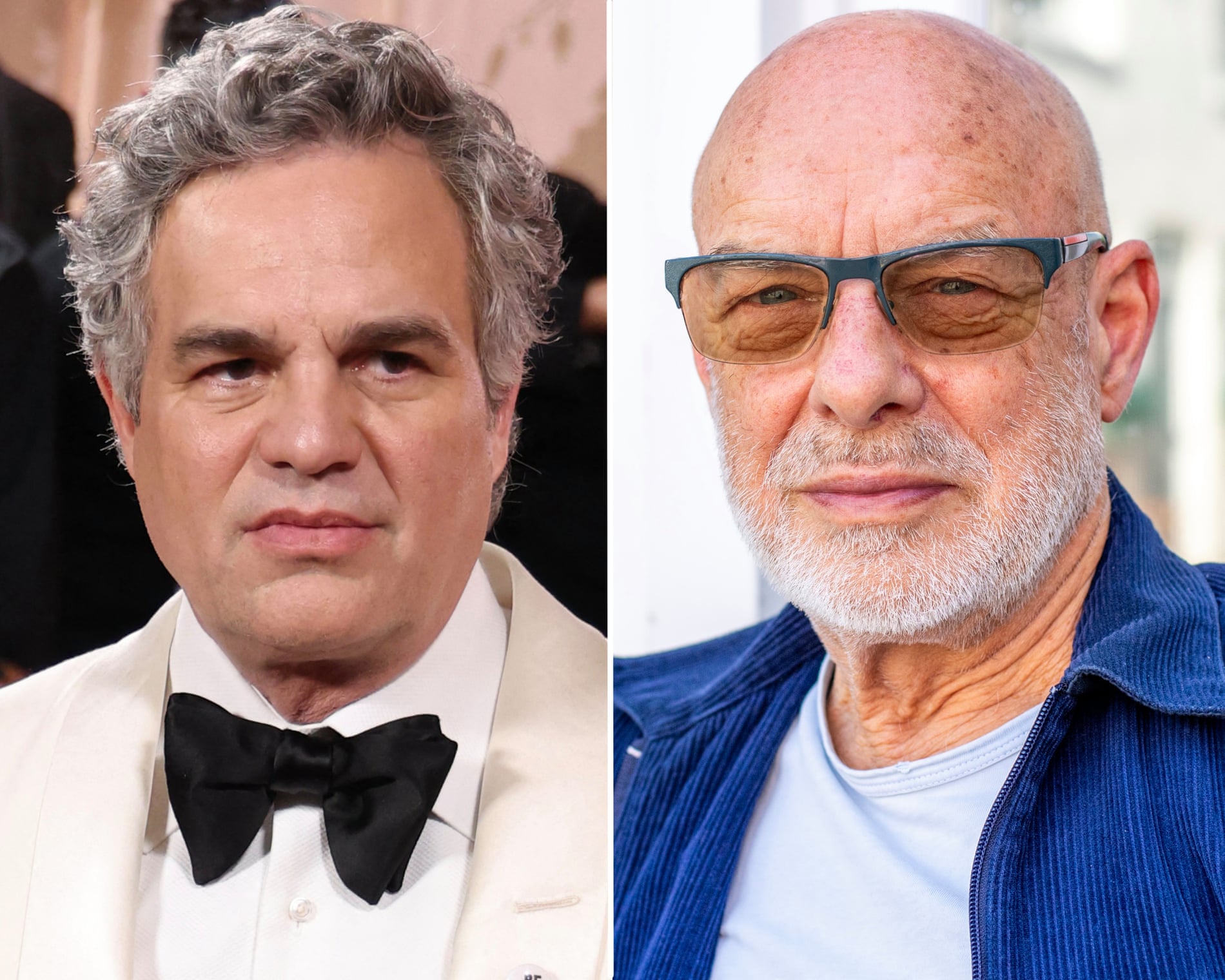

Nearly 400 millionaires and billionaires from 24 countries are calling on global leaders to increase taxes...

Nearly 400 millionaires and billionaires from 24 countries are calling on global leaders to increase taxes... United Parcel Service on Tuesday said it would cut up to 30,000 operational roles in 2026,...

United Parcel Service on Tuesday said it would cut up to 30,000 operational roles in 2026,...